Кремация домашних животных становится все более популярной услугой, позволяющей владельцам достойно проводить своих питомцев

Консультация ветеринарного врача играет ключевую роль в обеспечении здоровья и благополучия домашних животных.

В мире цифрового маркетинга TikTok занимает особое место благодаря своей динамике и широкому охвату

Мясо играет важнейшую роль в питании собак, так как является источником высококачественного белка, необходимого

Мини мальтезе – это уменьшенная версия известной породы мальтезе, отличающаяся своими компактными размерами и

Этикет подачи цветов также важен, как и их выбор. Вручая букет, следует делать это

Усыпление собаки – это ответственный и сложный процесс, который должен проводиться только квалифицированным ветеринаром.

Вельш-корги - это порода собак, завоевавшая сердца многих благодаря своему уникальному внешнему виду и

Ветеринарные аптеки обеспечивают доступ к качественным лекарственным средствам, что особенно важно для владельцев, стремящихся

Красная книга России является официальным документом, который содержит информацию о редких и находящихся под

Собака воет целый день: почему она это делает и как реагировать на это? Особенности

Собака кусается потому, что для нее это естественно. Главная проблема состоит не в том,

Существует несколько способов как можно предотвратить или исправить прыжки собаки на людей. Если у

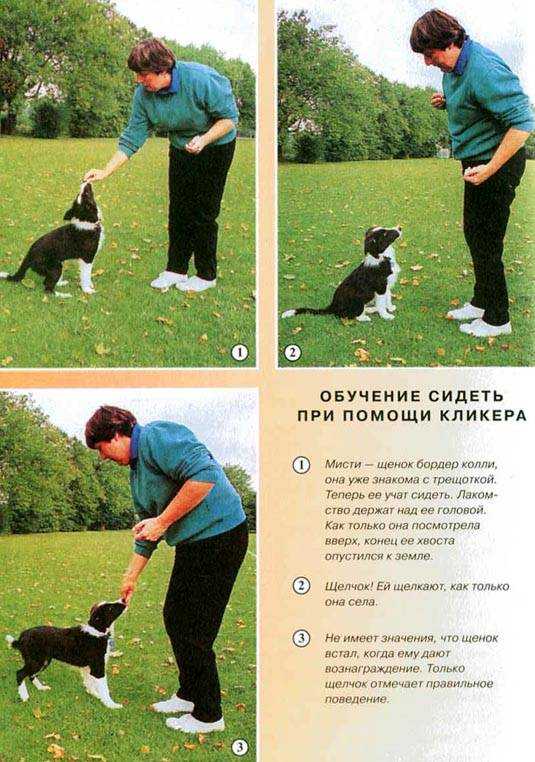

Методы и правила дрессировки. Инструкция и видео уроки. Как выпонять команду правильно. Закрепление изученного.

Многие люди уверены, что собаки кусаются, потому что "они для этого созданы". Но собака

Статья расскажет о том, как приучить щенка к туалету на улице с первых дней

Все, что необходимо знать о том, как приучить собаку к будке во дворе быстро

О том, как самостоятельно обучить собаку простым командам. С чего начать занятия и на

Как научить собаку команде "фас", не навредив психике животного. Методы обучения питомца, на что

✅ 10.10.2019 Как приучить собаку оставаться на месте Как научить собаку команде Место «Место»

Полезные рекомендации специалистов о том как научить собаку командам «нельзя» и «фу» самостоятельно, но

Предлагаем вам научить собаку команде «Фу», используя нашу пошаговую инструкцию и советы от профессионального

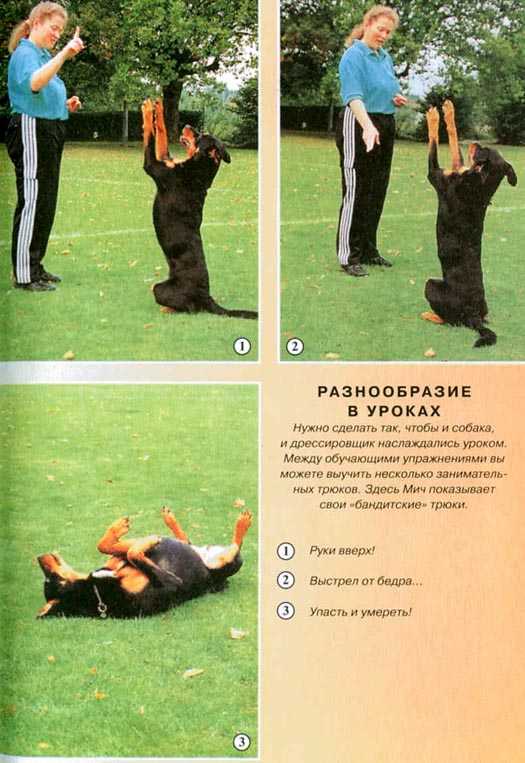

Притворяться мертвой - отличный собачий трюк, который развлечёт ваших гостей и друзей. .

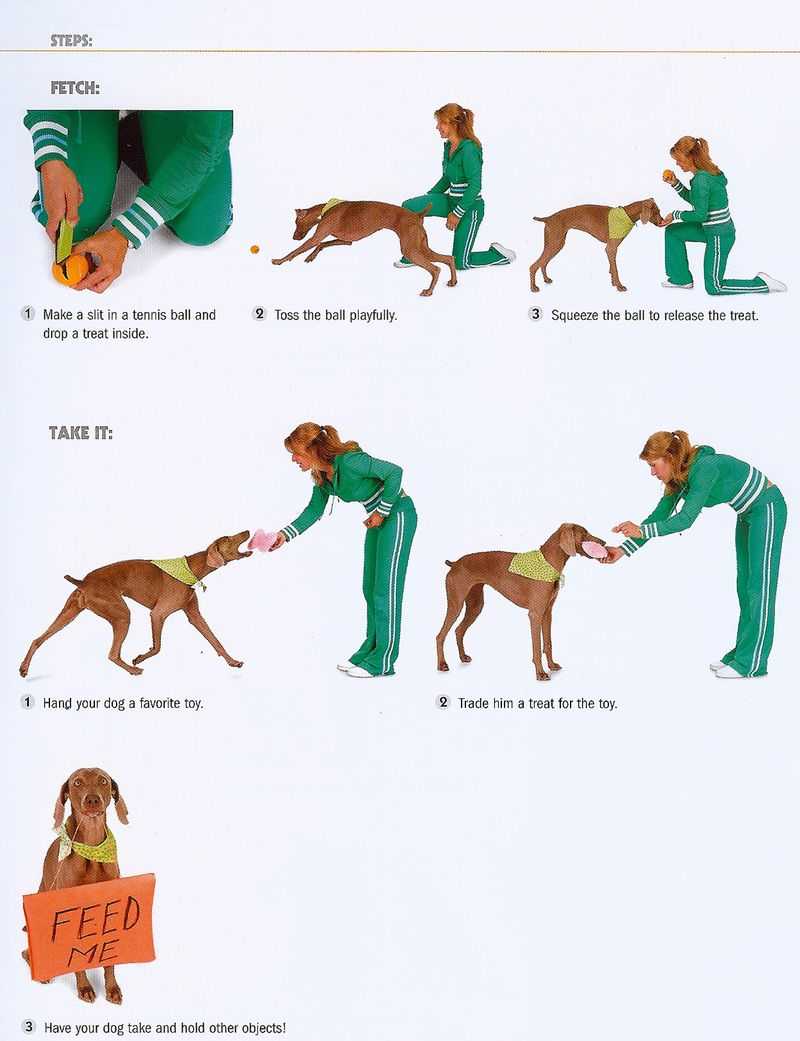

Давно хотите научить собаку приносить палку или игрушку, но не знаете как? В этом

Команда «Голос» является частью обязательных команд для собаки. Она входит в базовый норматив любого

Как отучить собаку лазить на стол. Причины некорректного поведения. Способы избавления от воровства и

✅ 05.11.2019 Как отучить собаку лаять на других собак Без лишнего шума — как